Antilles (ASX:AAU) carry on high-grade copper-gold at El Pilar

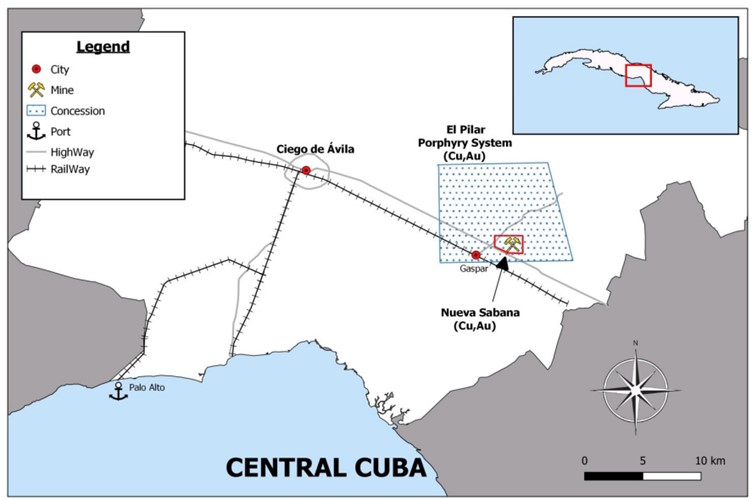

July 17, 2023Antilles Gold have continued to bring in high-grade gold and copper strikes, further reinforcing an attractive proposition to develop a Nueva Sabana open pit mine from the El Pilar oxide deposit in central Cuba.

Intercepts of 62.0m at 1.55% copper and 11.0m at 28.3g/t gold were the deserving headliners from a series of high-grade strikes which continue to extend the underlying copper domain both downward and outward.

Noted as a metallurgically simple deposit, test work has so far indicated a gold recovery of 85 per cent from a simple flotation circuit and a concentrate of 53.1g/t Au from a 2.11g/t Au head grade, suggesting a near-term boon from the overlying gold domain before mining into the copper prize lying beneath.

The results continue to indicate a low capex mine to be developed in equal partnership with Cuba’s state-owned mining company – a flat, unoccupied, yet infrastructure-rich mine site acquired for just US$1.5 million with minimal waste removal required and low-cost quotations.

Downhole highlights

Gold Domain

- 11.0 m at 28.3 g/t Au from 30.0m including 2.0m at 112.6 g/t Au

- 19.0 m at 11.56 g/t Au from 13.0m including 3.0m at 59.44 g/t Au

- 11.0m at 5.37 g/t Au from 1.0m including 1.0m at 40.72 g/t Au

- 2.41 g/t Au from 11.0m

Copper Domain

- 62.0m at 1.55% Cu from 38.0m including 12.0m at 3.18% Cu, and 14.0m

at 2.75% Cu - 23.0m at 1.2% Cu from 89.0m

- 48.0m at 0.73% Cu from 47.0m including 13.0 m at 1.17% Cu

- 14.0m at 1.32% Cu from 76.0 m including 4.0 m at 3.16% Cu

Forward plan

Metallurgical testwork on the underlying copper domain is ongoing, but the JV company has already begun negotiations with potential gold concentrate buyers to fund development through advanced sales.

Antilles Executive Chairman Brian Johnson expects both a Mineral Resource Estimate and the Pre-Feasibility Study for Nueva Sabana to be completed by the end of the year, and the company could soon have an operating mine on its hands and producing positive cash flow early into 2025.

La Demajagua gold

And Nueva Sabana could be one of a pair, with mine commissioning for a proposed La Demajagua gold, silver, and antimony mine earmarked for mid-way through 2025.

Antilles recently delivered a 30 per cent increase to La Demajagua, now holding over 900,000 ounces of gold equivalent, with recoveries and grades indicating that revenue will exceed $100 million per year from a mine life extended to 11 years.

The Cuban partnership has proven itself fruitful, and Antilles and GeoMinera SA intend to keep working on future mine developments, with part of the expected profits set to fund extensive exploration over a series of high priority targets.

The proposed Nueva Sabana mine

ANTILLES FPO [AAU]

ANTILLES FPO [AAU]Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.