How to build a successful lithium mine: Striking the right balance

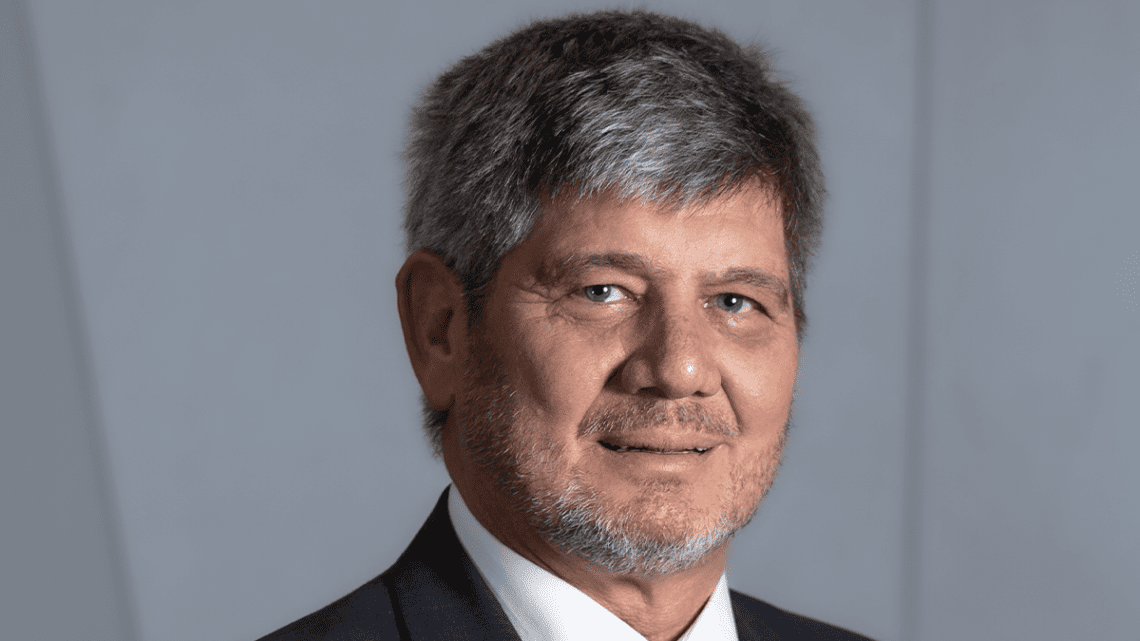

June 26, 2023Introducing Pat Scallan. With over thirty years of experience in the lithium industry gained from working at Talison Lithium and its predecessor, Gwalia Consolidated, Scallan is a highly skilled expert in his field. He will play a crucial role in bringing together a group of top industry professionals focused on helping Canada establish its first lithium concentrator.

During Scallan’s years at Talison, he oversaw multiple expansions to meet the surging demand. As a trusted advisor at Lithium Universe, Pat shares his insights and warns newcomers in the expanding market of potential pitfalls.

“Back then, our business primarily focused on spodumene, which was mainly used for glass and ceramics, and electric vehicles were not yet a significant market,” Scallan says.

“Our lithium carbonate plant faced obstacles and was decommissioned due to oversaturation in the market. Thanks to their streamlined processes, we shipped concentrates to China for conversion, which was cost-effective. The raw spodumene’s price varied, but chemical transfer prices were lower at around $150 per tonne.”

Scallan in his long-serving days as General Manager at Talison Lithium.

Although facing tough competition from more affordable alluvial coltan, we had the foresight to see the potential in tantalum and ended up supplying half of the world’s tantalum. Interestingly, lithium played a significant role in keeping us afloat for a longer period than we may have expected.

As the early electric engines began to operate, intelligent investors sensed a chance to acquire the struggling company. This led to the establishment of Global Advanced Metals and Talison Lithium, and the collaboration between Tianqi and Albemarle produced the massive Greenbushes ore deposit. Thus, the era of lithium had officially begun.

How much lithium was produced during the early days, and what was the peak production level in later years?

When we started, the feed grade was around 3%. However, as our production volumes and prices increased, cutoff grades dropped to as low as 1% when I retired in 2020. The bell curve flattened out at around 1%, making it conducive to bulk mining and reducing unit costs, ultimately benefiting the economics of the mine. We produced about 1.2 million tonnes of products at my retirement, which had now increased to 1.4Mt and, after the planned expansions, could reach 2.4Mtpa, a massive leap from the initial 300,000 tonnes per annum when I started in 1995.

What did you learn about building and operating a producing mine over that time?

We had to quickly expand production when the prices started to increase because of the pressure on demand. We learned there is a delicate balance between feed grade, final product grade and recoveries and yields. That was important because as you pushed ore through a plant, your results dropped, and one of the easy ways to increase production was to drop your final product grade and accept lower yields.

Through many trials, we learned how to modify our plants to achieve our desired outcomes of increased production or production of high-quality products. However, industrial mineral prices fluctuated wildly, causing profit margins to vary substantially. We aimed to maintain a profit margin to cover our operating costs and overheads, which required balancing these factors constantly. Unlike gold, whose price remains steady with price variations offset by exchange rates, industrial metal prices rise and fall rapidly due to supply and demand pressures.

Based on your knowledge, could you shed light on why lithium projects across the globe are facing delays in their development?

Often, companies decide to proceed too quickly with a project because of the potential profits without adequately accounting for price fluctuations. The cycle changes so quickly that a lot of the time, you’re halfway through doing your project, and the market has changed, and cash flow becomes tight.

Margins play a significant role in determining profits in business. The fluctuation in prices can cause inconsistency in earnings. These low margins can hurt a company for an extended period. It is common for projects to appear promising with low grades and high margins when the price is right, but once the margins drop, low-grade projects need help to keep the operation afloat for the long term.

How do you build a safety net strategy to prevent cash from drying up in the bad times?

Australia is fortunate to have become a prominent supplier to the lithium industry. Previously, our biggest competitors were brined producers. However, we have increased our volumes and constructed downstream processing plants to meet the demand, allowing us to manage some market pressures. This has enabled us to establish a base load of production necessary to meet the demand for downstream processors to function and maintain a profitable business. Our ability to manage these changes is due to our outstanding market share and great orebodies.

Can you provide more details on how your extensive experience has informed your approach to the Lithium Universe strategy?

Our extensive industry connections, combined with our market understanding and experience in these established markets, provide us with a unique advantage in constructing concentrators and other downstream infrastructure efficiently and effectively. As a result, we can show operations in Canada quickly, in line with our forecasted costs and reliability, without encountering long-term commissioning issues. I have overseen numerous expansions throughout my career and successfully brought them online on time and within budget.

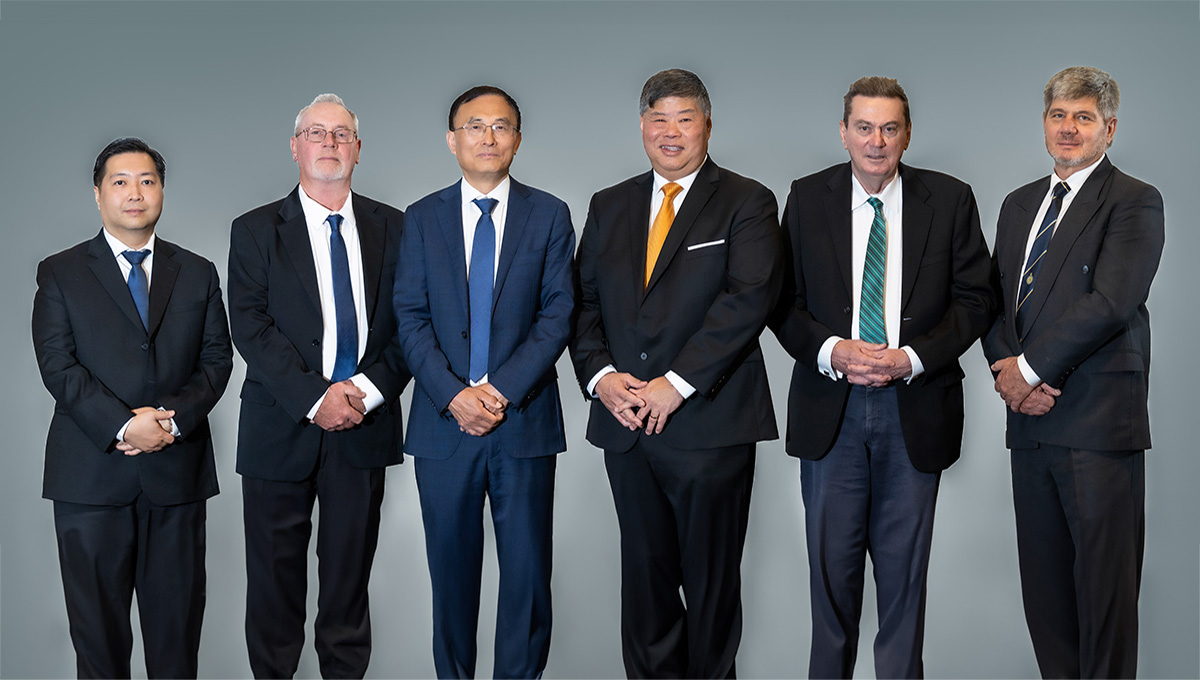

Iggy Tan’s ‘Lithium Dream Team’ includes Mr Patrick Scallan, a seasoned lithium expert who successfully managed the Greenbushes Mine for 25 years, and Dr Jingyuan Liu, Terry Stark, Roger Pover, and Huy Nguyen, who have all held executive roles at Galaxy Resources Limited and, like the legendary collection of hoopsters, are masters of their craft and won’t be out-hustled.

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.