Talisman (ASX:TLM) grabs IOCG potential at Mabel Creek

January 30, 2023Talisman Mining will take 100% ownership of a potential global scale copper-gold opportunity confirming a binding agreement to acquire the Mabel Creek Iron Oxide Copper Gold (IOCG) project in South Australia.

The Company says the under-explored Gawler Craton project significantly boosts its copper-gold portfolio acquiring 3 licenses covering more than 1000 square kilometres in the under-explored Gawler Craton hosting the likes of BHP’s world class Olympic Dam and Oz Mineral’s Carrapatena & Prominent Hill Projects.

“The strategic acquisition provides Talisman with exposure to Tier-1 deposit discovery potential in an extremely prospective area known to host multiple deposits concealed below cover” the Company said.

“[The] acquisition [also] further strengthens Talisman’s Australian copper-gold portfolio as it embarks on a potentially transformational drilling campaign at its Lachlan Copper-Gold Project in NSW”.

About Mabel Creek

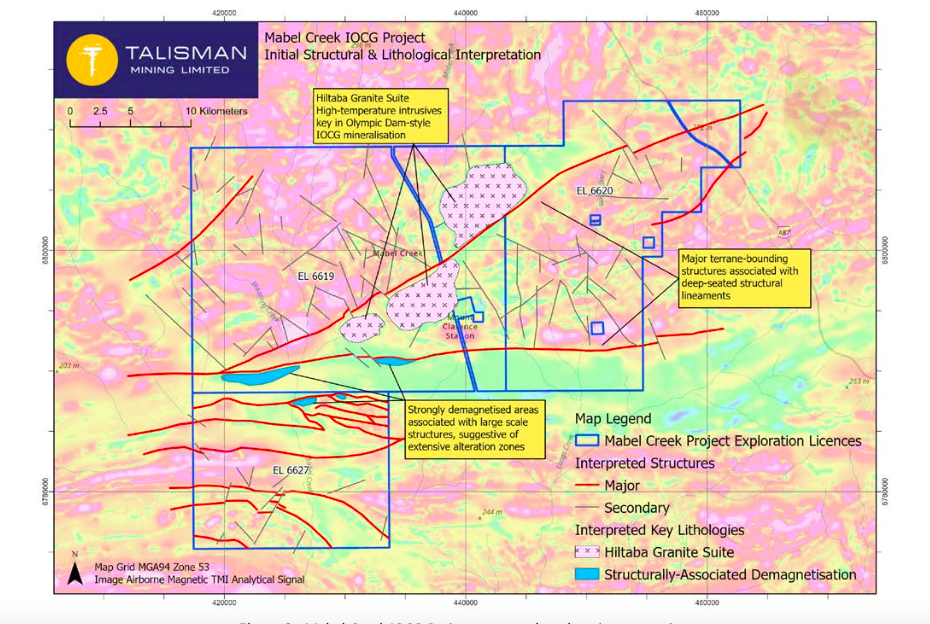

The Mabel Creek Project contains prospective lithologies and a number of significant structures thought to be associated with Olympic Dam-style IOCG mineralisation and Gawler Craton-style gold mineralisation.

About the Mabel Creek Project

The Mabel Creek Project area was initially identified as part of the South Australian Government’s “Gawler Challenge” in 2020 and was identified by both the winner and runner-up of the competition as one of the most significantly prospective yet under-explored areas in South Australia for IOCG and Gawler.

Mabel Creek IOCG Project structural geology interpretation

“The Mabel Creek Project acquisition further enhances our existing exploration portfolio and complements our focus on copper and gold exploration opportunities within highly prospective Australian locations,” the Company said.

“Such a low-cost acquisition, with no trailing royalty obligation – strategically located near existing world-class mineral deposits – is a great outcome for Talisman.

“Logistically, the Mabel Creek Project area is easy to access with excellent existing infrastructure and provides our exploration team with an additional focus area alongside our NSW tenure, opening up an exciting new and complementary front for exploration activity and news-flow.

”We are looking forward to working proactively with the Antakirinja Matu-Yankunytjatjara Aboriginal Corporation to finalise an access agreement and commence on-ground exploration activities in what is undoubtably an excellent exploration address for Tier-1 discoveries.”

Key Terms of the Agreement

In consideration for transfer of a 100% interest in the Mabel Creek Project, Talisman will:

- on execution of the Agreement, pay First Au $100,000 in cash; and

- within 5 business days of obtaining the necessary approval from the South Australian Department for Energy and Mining for the transfer of the Project Tenements (the Deferred Consideration Date):

- pay FAU a further $100,000 in cash; and

- issue fully paid ordinary shares in TLM to the value of $100,000, with the quantity being determined by an issue price equal to the greater of $0.135 per share or the 5- day volume weighted average price (VWAP) traded on the ASX during the 5 trading day period ending the business day prior to the Deferred Consideration Date (see the attached Appendix 3B).

If the necessary approvals and registration of transfers in respect of a Project Tenement are not obtained within 4 months after the execution of the Agreement, either party may terminate the Agreement in respect of that Project Tenement. In that case, the transfer of that Project Tenement will not occur, the balance of the consideration applicable to that Project Tenement will not be paid, and one-third of the initial cash payment is refundable to Talisman.

Price Action

The Company’s ASX-listed shares are 16c in morning trade.

About Talisman Mining

Talisman Mining Limited (ASX:TLM) is an Australian mineral development and exploration company. The Company’s aim is to maximise shareholder value through exploration, discovery and development of complementary opportunities in base and precious metals.

Talisman has secured tenements in the Cobar/Mineral Hill region in Central NSW through the grant of its own Exploration Licenses and through a joint venture agreement. The Cobar/Mineral Hill region is a richly mineralised district that hosts several base and precious metal mines including the CSA, Tritton, and Hera/ Nymagee mines. This region contains highly prospective geology that has produced many long-life, high-grade mineral discoveries. Talisman has identified a number of areas within its Lachlan Cu-Au Project tenements that show evidence of base and precious metals endowment which have had very little modern systematic exploration completed to date. Talisman believes there is significant potential for the discovery of substantial base metals and gold mineralisation within this land package and is undertaking active exploration to test a number of these targets.

Talisman also has a majority participating interest in a joint venture with privately-owned Lucknow Gold Limited in relation to the Lucknow Gold Project (EL6455) in New South Wales. The Lucknow Goldfield was discovered in 1851 and was one of the earliest goldfields to be mined commercially in Australia. Historic production records at the Project are incomplete, however in excess of 400,000 ounces of gold has reportedly been produced at grades of 100 to 200 g/t gold 1.Very little modern exploration has been completed outside of the existing mine workings and Talisman intends to undertake a program of geochemical surface sampling and mapping at the Project ahead of a drilling program to test for potential down plunge extensions of the high-grade gold ore shoots and repeat structures throughout the Project area.

Fundamental Data

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.