Lithium Universe (ASX:LU7) shakes on North American refineries option

February 21, 2024Lithium Universe has lined up a $14.1 million option agreement to allow it to snap up industrial land in the Canadian province of Quebec near key infrastructure to be used for up to three lithium refineries in the North American electric vehicle battery market.

The Western Australian company hopes to address a lithium conversion capacity gap in key Western markets and could advance its plans by positioning one or more refineries on the landholding in Becancour, Canada near the critical minerals-hungry US.

The Subiaco company’s land opportunity complements its existing lithium assets in North America and Australia and could conveniently position it near key auto manufacturers in Canada.

If it takes up the option, building one or more refineries on the site would allow its product to be sold into the US East Coast where a substantial surge in lithium-containing battery manufacturing is expected.

More than 20 major battery manufacturers hope to deploy about 900 gigawatts of battery capacity on the coast by 2028.

Lithium Universe Chairman Iggy Tan said the company’s refinery land deal with the Québec-incorporated landholder Société du Parc Industriel et Portuaire de Bécancour was a step forward.

“This is just another positive step forward for the company as we secure this key landholding in the most attractive emerging battery-focused jurisdiction,” he said.

“Québec’s low-cost hydroelectricity, high environmental standards, and educated workforce, as well as the location’s logistical advantages, including a deepwater port and easy rail access to the rest of North America, were key factors in the decision.

“One of the reasons we like the site is that it gives us the opportunity to expand. We have the ability to do that if necessary.”

Filling a lithium conversion capacity gap

Lithium Universe’s option deal for land in Parc industriel et portuaire de Bécancour for C$12.6 million ($14.1 million) remains subject to shareholder and regulatory approvals.

The company views the refineries land option as an integral component of its Québec Lithium Processing Hub Strategy.

Any refineries landholding the Australian company secures can help it advance its wider plan to address a lithium conversion capacity gap in the North American market.

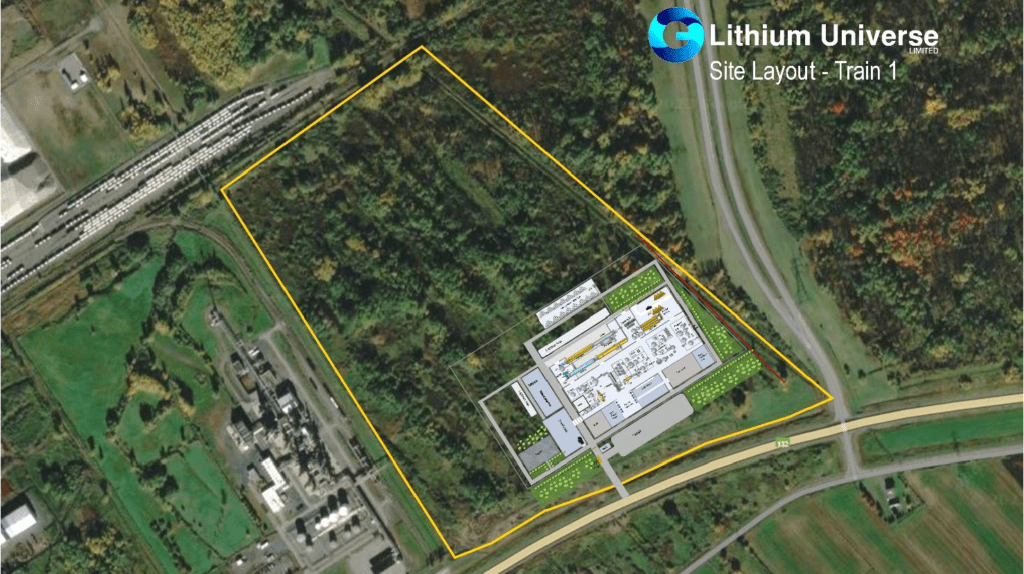

The strategically located SPIPB Bécancour site, lot 22, is a massive 276,423 square metres, meaning it can house up to three lithium carbonate refineries with capacity for 16,000 tonnes a year.

Bécancour industrial park is near vital infrastructure, including hydroelectricity, gas, road, rail, and spodumene import facilities.

The SPIPB park site is also conveniently located close to key electric vehicle battery materials markets, just a one-kilometre trip to the General Motors/POSCO Cathode factory and the Ford/EcoPro BMCathode factory. It’s a handy 140km trip to the Northvolt EV battery facility at Saint-Basile-le-Grand.

Lithium Universe’s 36-month option agreement allows it to grab the land without an option fee until July 2024.

Alternatively, it can pay C$63,135 ($71,226) a month for up to 30 months from that month and bring down the purchase price with each payment.

No additional financing is required for the deal in the short term, although any infrastructure works conducted at the site will require additional cost-outlays for the WA company.

Lithium Universe shares where it could host a Bécancour lithium refinery near North American markets in Québec, Canada

To view a summary of Lithium Universe’s Bécancour lithium refinery concept, see the company’s investor hub at https://investorhub.lithiumuniverse.com/link/XyMO4r

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.