Lunnon (ASX:LM8) finds for WMC nickel at Hanging Wall

March 3, 2023Lunnon Metals re-assays have doubled down on high-grade nickel results first drilled by the once mighty WMC Resources at Lunnon’s Silver Lake-Fisher project, part of Lunnon’s nickel rights tenure at the historic Kambalda Nickel Project in Western Australia.

Grades reaching up to 10.23% were recorded from 4100m of historic drilling at the Kambalda mine’s Silver Lake Hanging Wall prospect, which have not been explored since WMC’s ownership several decades earlier.

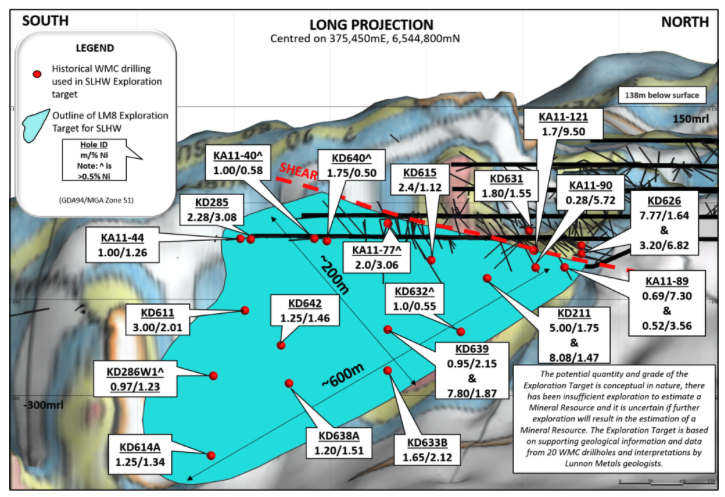

Long projection of the newly identified prospective SLHW Exploration Target with previous WMC approx. 100m x 100m diamond drill coverage annotated with key assay results greater than 1.0% Ni unless otherwise labelled.

Silver Lake, Kambalda’s first nickel mine, produced 123kt nickel metal, with up to half its production coming from hanging wall surfaces.

Meanwhile, Fisher holds 38kt historic nickel production from multiple nickel channels remaining open to the south and down flank.

Lunnon Managing Director Ed Ainscough said the validated WMC results would be used to report a JORC Mineral Resource Estimate for the Silver Lake-Fisher Project.

“We were confident the existing geoscientific data was accurate, but it is still pleasing to demonstrate that to current standards,” Mr Ainscough said

“The historical WMC core is a fantastic resource, saving time and resources – and can add important metal to our inventory while allowing us to allocate more funds to our own drilling.

“As we have shown at the Foster nickel mine, the ability to add Mineral Resources independent of the drill rig differentiates Lunnon Metals, which when coupled with the progression of the Baker discovery and the exciting targets at the SLHW and Long South “Gap” prospects, promises strong newsflow throughout 2023.”

Surface drilling activities are about to commence to test for potential high-grade shoots.

Highlight Results

- KA11-34 3.00m @ 2.00% Ni (from 61.40m);

- KA11-89 0.69m @ 8.16% Ni (from 68.36m);

- KA11-106 1.48m @ 8.04% Ni (from 64.18m);

- KA11-108 2.20m @ 4.21% Ni (from 61.38m); and

- KA11-121 1.44m @ 10.23% Ni (from 72.00m)

In addition, re-assaying of nickel mineralisation on the main komatiite-footwall basalt contact beneath the SLHW prospect recorded:

- KD632 11.00m @ 0.64% Ni (>0.5% Ni cut-off from 548.00m); and

- KD633B 0.90m @ 2.44% Ni (>1.0% Ni cut off from 640.60m)

Nickel Market Outlook

The outlook for the nickel market is mainly positive as increasing demand from large stainless steel producers in Asia is rising prices. Nickel demand is expected to continue to increase, driven by the growing demand for stainless steel and other nickel-containing products. On the supply side, mine production is projected to increase over the next few years, especially in Indonesia and the Philippines, two of the world’s largest nickel producers. This could contribute to higher prices for nickel, as more demand for metal combines with increasing supply. Looking ahead, the increasing demand for nickel should help to support stable pricing and overall solid market sentiment.

Nickel Prices: Source Trading Economics

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.