The growing pains of energy transformation

March 2, 2023Investors in lithium can see some fundamental structural issues define the sector. The first is the lack of sufficient lithium development projects to satisfy forecast demand in the medium to long term — there aren’t enough mines planned to meet the burgeoning demand for lithium.

A yawning supply deficit looms!

It’s a severe threat that can delay the decarbonisation goals that western nations have publicly set.

What a predicament for these governments to face having ventured so far down the road, it would be unmentionable to consider a backdown now.

Hence, we witness a rush by public and private entities alike to secure at least their share (if not more) of any visible future supply. For instance, the car industry continued to cover some of its needs this month with GM’s massive $650 million investment in Lithium Americas.

Another key driver is imperative to establishing regional lithium supply chains less vulnerable to geopolitical shocks (in other words, China). This imperative is hardly rocket science considering China’s dominant global lithium supply chain position.

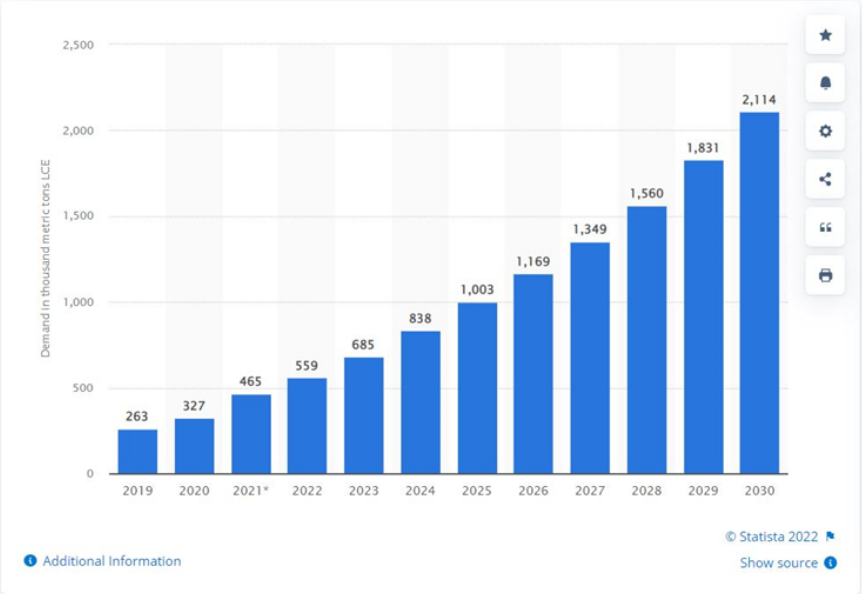

Projection of worldwide lithium from 2019 to 2030 Source: Statista

Western governments are openly pushing to create buyer-seller networks with allied and like-minded nations to counter potential vulnerability to Chinese influence, made all the more urgent after the dislocation of energy markets in the wake of Russia’s invasion of Ukraine.

Now, it spooked governments and industry alike, who fully recognise that lithium will be the economic lifeblood of the future.

Without sufficient lithium resources in Europe, German car makers dispatched Chancellor Scholz himself to bolster their efforts to secure more material from Chile and Argentina.

Scholz also encouraged his hosts to process the lithium themselves rather than sending it to the Chinese lithium processors and battery makers.

That’s the reality of the fast-expanding lithium industry – it is designed to be fragmented and regional, not global and free.

This is a complication many analysts appear to overlook – material will not flow back and forth freely in some easy global supply and demand model; it will be regionalised and often nationalistic. Case in point: Mexico has just moved to nationalise its lithium reserves, and new lithium deposits in India may well be subject to restriction if they are ever developed at all.

It’s remarkable how at one end of the spectrum, geopolitics are shaping the future of lithium supply. On the other hand, mining and industrial processing remain as basic and complicated as ever.

Several lithium projects this month announced slippages in their start-up schedules, not drastic in the long-term, but indicative of the wealth of issues and complications that combine to bedevil and delay production from new sites, making it much more complicated in real life than it ever looks in the investor pack flow charts.

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.