Voltaic (ASX:VSR) launch Phase 2 at Ti Tree

June 5, 2023Voltaic Resources have swiftly launched Phase 2 drilling at Ti Tree after its first stage struck pegmatites as wide as 58 metres from surface at the lithium-caesium-tantalum project in the West Australian Gascoyne.

Up to 30 drill holes and 3000 metres are directed at defining the extents and along-strike continuity of the pegmatites while testing a half dozen additional targets at the Andrada Prospect and a nearby Morpheus target.

Both prospects sit in a Volta Corridor well-endowed by lithium-bearing pegmatites, recently exemplified by a 56m at 1.12% Li2O strike at neighbouring Yinnietharra, where Delta Lithium is committing to an extensive drill program.

Voltaic CEO Michael Walshe says that success from shallow first-phase drilling resulted in a share price surge and a $7.1 million raising to fast-track the next round of drilling.

“Our Phase 1 campaign has barely scratched the surface in terms of understanding the depth and scale potential of our tenure,” Mr Walshe said.

“Its purpose was to understand structure and continuity; using the drill bit as an exploration tool as we vector to the most prospective parts of the project area.”

Walshe added that initial rock chip campaigns identified more than 300 pegmatites in Voltaic’s end of the corridor, confirming several as geochemically fertile for LCT mineralisation.

“Phase 1 drilling confirmed that many of these pegmatites have significant size potential, and we still have not identified their structural bounds. Following the extremely strong level of support for the $7M Placement, we are now well funded to realise our ambitious plans to vector to the best part of our tenure at Ti Tree,” he said.

“Additionally, target generation continues to generate LCT targets along the most prospective lithological schists associated with the ‘Volta Corridor’, with rock chip sampling, geological mapping, and soil sampling programs all underway across Ti Tree (South), and several geophysical surveys are planned to commence in June.”

Lithium outlook

After a half-year pullback in lithium prices, investors are starting to believe a new wave of lithium investment is beginning to swell.

Citigroup declared a collapse in prices was likely to be over and is now tipping prices to rebound by 40 per cent before the end of the year as downstream producers start to see a lack of upstream investment short-circuiting EV ambitions.

General Motors invested US$650 million to secure supplies and analysts see a market sitting ripe for a surge in mergers and acquisitions.

Forward plan

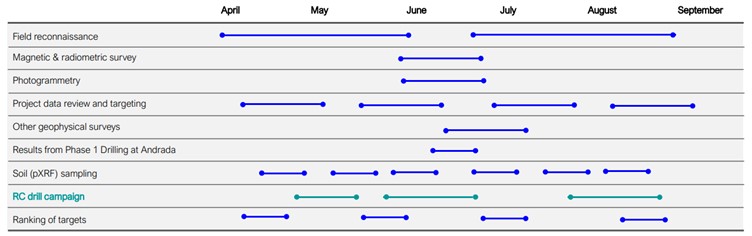

Planned and completed activities at Ti Tree

Voltaic will continue to generate targets with rock chip sampling, geological mapping, and soil sampling all underway at Ti Tree’s southern end, with several geophysical surveys to launch this month alongside the much-anticipated return of assays.

Project location map

VSR Price Chart

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.